Loan borrowing capacity

Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. Changing the interest rate and loan term can have a significant impact on your borrowing power.

Loan Dashboard For Banks Example Uses

The application fees are generally around 500 600 though they can be more than 1000 depending on the loan and lender.

. The 5 Cs of. 2 The annual renewal fee is currently one-half of one percent 05 of the outstanding principal loan balance as of December 31. The system weighs five characteristics of the borrower and conditions of.

Call us at 13 10 90 7am - 7pm Monday to Friday. An interest rate is the amount of interest due per period as a proportion of the amount lent deposited or borrowed called the principal sumThe total interest on an amount lent or borrowed depends on the principal sum the interest rate the compounding frequency and the length of time over which it is lent deposited or borrowed. Get 247 customer support help when you place a homework help service order with us.

A higher income shows that you have a better financial bandwidth to repay the loan on time. For example personal loans are shorter tenure loans up to a maximum of 5 years whereas home loans are longer tenure loans which can go up to a maximum of 25-30 years. Minimum auto loan amount is 3750.

The five Cs of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. Must contain at least 4 different symbols. The interest on the loan denotes the cost of your borrowing.

Capacitymeasures a borrowers ability to repay a loan using a ratio to compare their debt to income. Compare home buying options today. So make sure you assess your repayment capacity using a loan EMI.

See how you can minimise the total amount you need to pay. Evaluate your borrowing capacity and factors that influence it. Alcohol and Tobacco Tax and Trade Bureau TTB Bureau of Engraving Printing BEP Financial Crimes Enforcement Network FinCEN Bureau of the Fiscal Service BFS.

The loan-to-value ratio LVR of a home loan is the amount you are borrowing under it as a proportion of the lenders valuation of the property youre buying. The 5 Cs of credit are character capacity collateral capital and conditions. Buying or investing in a new property we have a variety of tools and calculators to.

And read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. A debt or equity issuance in which the purchaser does not pay the full value of the issue up front. TBC in its capacity as a broker provides research and matching.

ASCII characters only characters found on a standard US keyboard. Five Cs Of Credit. The computation of interest charged on the loan must be based on the amount of principal remaining after deducting from the original principal the total payments made by or on behalf.

Your income denotes your capacity to repay a loan. The Borrowing Club prides itself on customer service and customer satisfaction. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments.

Loan rates and terms applicable to new vehicles only. Alternatively 61 7 3017 8899. This means that your risk level is low.

6 to 30 characters long. This is not a commitment to provide a loan approval or a specific interest rate. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

For a term of 60-months based on new car rate of USEDREFINANCE. In an efficient market higher levels of credit risk will be associated with higher borrowing costs. How the interest rate and loan term can impact your borrowing power.

The best way to boost your borrowing power is by cutting your expenses and increasing your income before applying for a loan. County Florida however TBC is licensed as a broker andor lender in various states including California. For example a bank may approve your loan for 80 of the property value an LVR of 80 in which case you would need to pay the remaining 20 as your deposit.

Lenders prefer individuals with low risk profiles and may hence offer you a lower interest rate. Use Canstars home loan selector to view a. Loan tenures vary depending on the type of loan loan principal and also the lender you are borrowing from.

Learn how to improve your borrowing capacity. A personal loan is your least expensive borrowing option. Based on your deposit and loan payment ability.

If a borrower fails to repay the loan on time the maximum rate of late interest a moneylender can charge is 4 per month for each month the loan is repaid late. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. You dont have any collateral to offer.

The renewal fee rate is set annually by Rural Development in a notice published in the Federal Register. New vehicles are defined as the current or previous model year vehicle with less than 5000 miles. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Unsecured loans generally feature higher interest rates lower borrowing limits and shorter repayment terms than secured loans. A loan term is the duration of the loan given that required minimum payments are made each month. The good thing is that knowing these factors can help you take the necessary steps to improve your borrowing capacity.

The lower the interest rate the higher your borrowing capacity as the total amount of interest applicable to the entire life of the loan will be lower assuming interest rates. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Approximately 40 of home loan applications were rejected in December 2018 based on a survey of 52000 households completed by DigitalFinance Analytics DFAIn 2017 to 2018 Hunter Galloway submitted 342 home loan applications and had 8 applications rejected giving a 233 rejection rate.

In the purchase of an installment receipt an initial payment is made to. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of debt Retirement calculator. The above-discussed factors can greatly impact your borrowing power when applying for a loan.

Rate applies to loan amounts up to a maximum of 100000. Borrowing Fees can include. A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property.

The rate in effect at the time the loan is made will remain in effect for the life of the loan. In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial.

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

What Can Affect Your Borrowing Power

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

What Is Asset Based Lending Who Qualifies

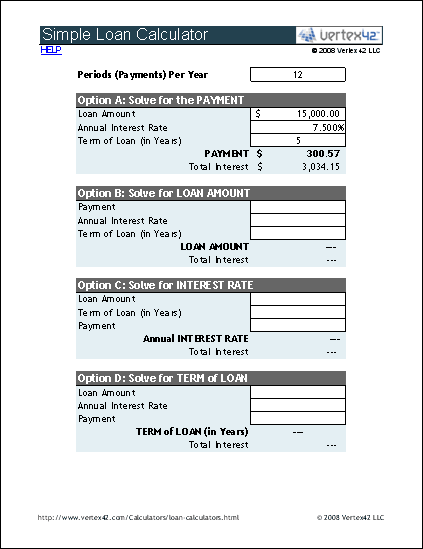

Loan Calculator Free Simple Loan Calculator For Excel

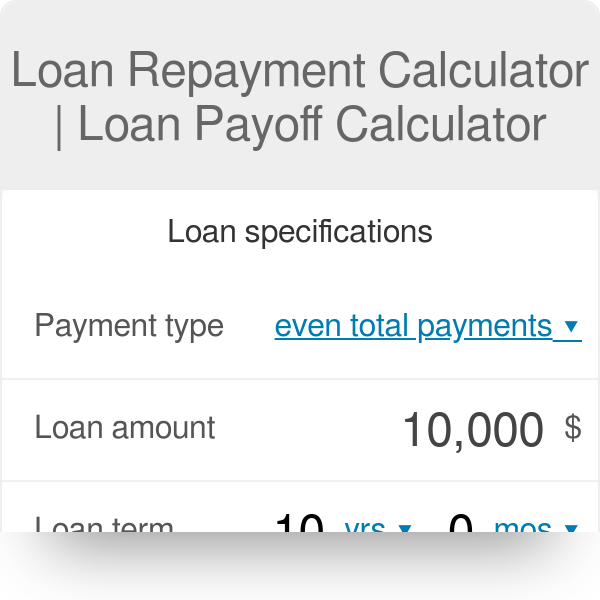

Loan Repayment Calculator

The 5 C S Of Credit What Lenders Look For

Loan Calculator That Creates Date Accurate Payment Schedules

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Simple Loan Calculator

How Much Can I Borrow Home Loan Calculator

Borrowing Capacity Explained Your Mortgage

Advanced Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

Measuring Repayment Capacity And Farm Growth Potential Farmdoc Daily